Generating meaningful outcomes for Customer Empowerment, Collection Efficiency and Cost Efficacy

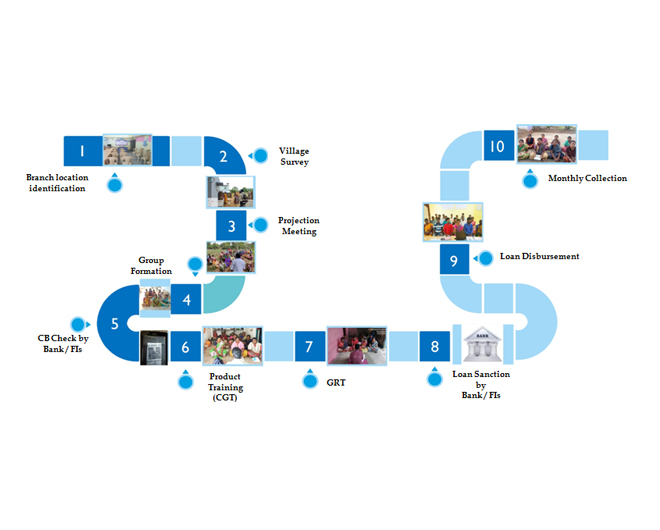

Our survey comprises evaluation of varied factors like employment opportunities, well irrigated agricultural land, logistically connected with semi-urban areas, good internet connectivity which form the basis of our selection criteria. Moreover, we do peer benchmarking and market research of the 4-5 shortlisted talukas to finalise the branch locations. One branch covers 30 villages comprising only 2-3 borrower groups per village.

We undertake 3 level KYC verification followed by a Credit Bureau (CB) check to determine the eligibility of the borrower group. This is supplemented by an economic stability check, home e-verification and related checks of the eligible groups. A further KYC and CB Verification by partners is done basis Finsigma recommendation for final go ahead.

Mandatory Group Training is done by the sourcing team to explain the end-to-end loan process and collection norms. This is followed by a GRT stage verification by the credit team independently covering critical parameters. We ensure a mandatory meeting with the nominee to explain the whole process and the indirect guarantee for the group borrowers before final disbursement

The proximity to the borrowers through branch location is ensured from the beginning. The 'collection meetings' dates are pre-decided at the time of disbursement and occurs every month. Every borrower has to pay on the due date. If one fails, the whole group is marked as default. This also helps in mitigating branch level frauds.

Technology is very critical for our operations as it gives opportunities for reducing costs of delivery and process management, besides bringing about transparency in our operations. We have a technology embedded process right from instituting an integrated back office to client on-boarding. Our collection and receipt issuing process is further augmented by technology.

Monthly meetings help tracking the financial stability of the borrowers. Our tele calling team calls individual borrowers within the first week of disbursement and then every quarter to stay engaged with the borrowers actively and beyond the branch staff. Our tele calling team has all women employees providing a comfortable and an empathetic approach to the borrower to share their issues without any hesitation.